Did you know? You can more than double your impact on Wyman’s programs for a minimal additional cost with tax credits!

The Missouri Department of Economic Development awarded Wyman Youth Opportunity Tax Credits – which can give YOU a tax credit equaling 50% of your donation to Wyman. By making a qualifying donation of $1,000 or more, you not only save money on your taxes, but you are helping Wyman connect teens to their voices, their strengths, and their futures through proven programs and supports.

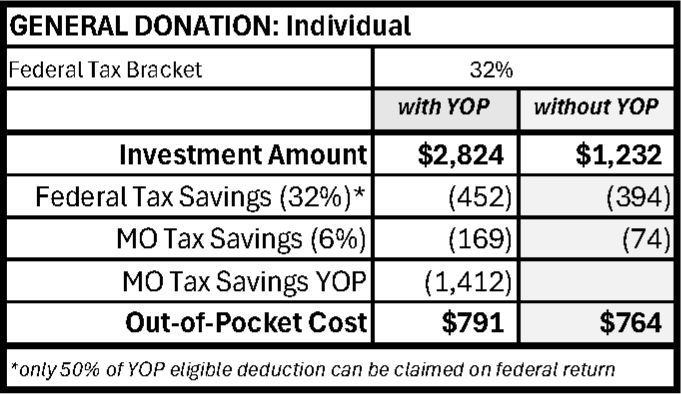

Your gift of $2,824 provides a full session of Wyman programming for 3 teens.

Your gift of $1,232 provides a year of leadership and success coaching for 1 teen.

When you utilize YOP tax credits, the out-of-pocket cost for your donation of $2,824 is only $27 MORE than a $1,232 donation.

This example does not represent tax advice. Consult your tax advisor to understand how tax credits may benefit you.

Missouri’s Department of Economic Development also awarded Wyman Neighborhood Assistance Program (NAP) tax credits to support our capital campaign. Eligible donors can utilize NAP to receive a tax credit equaling 50% of their gift to Wyman, lowering their total out-of-pocket cost.

About YOP

Who Qualifies for YOP?

These credits are available to qualified individuals and corporations, with an eligible gift of $1,000 or more. Corporations or individuals paying Missouri state income tax AND increasing their annual gift to Wyman or donating to Wyman for the first time are eligible. Additionally, gifts made via check, credit card, and stocks qualify.

Qualified YOP donors include:

- Individuals

- Businesses with Missouri state tax liability

About NAP

Who Qualifies for NAP?

These credits are available to qualified individuals and corporations, with an eligible gift of $1,000 or more to support Wyman’s Capital Campaign.

Qualified NAP donors include:

- Corporations

- Farm Operation

- Financial Institution

- Individual partner in a Partnership or shareholder in an S-Corp

- Individual reporting income from rental property or royalties

- Insurance Company

- Limited Liability Corporation or Partnership

- Partnership

- Sole Proprietorship

- Small Business Corporation

The list of NAP qualified donors can be found here.

How can YOU benefit from these programs?

You may apply your charitable donation to your federal and state income tax returns and also receive an additional 50 percent Missouri State Tax Credit. Once you receive the tax credits, they may be applied to the tax year in which the donation was made, or at any time in the next five tax years.

Complete the form below or contact Hannah Branson to find out if your contribution is eligible for YOP or NAP, Hannah.Branson@wymancenter.org or 314.835.7638.

Please note that the Missouri Department of Economic Development requires all NAP and YOP applications and supporting documentation to be submitted within one year of the donation date. Additionally, applications submitted past that deadline will not be accepted.

Interested in Tax Credits

Fill out this form and we will be in touch!

"*" indicates required fields